Melissa Cartier

Hi there,

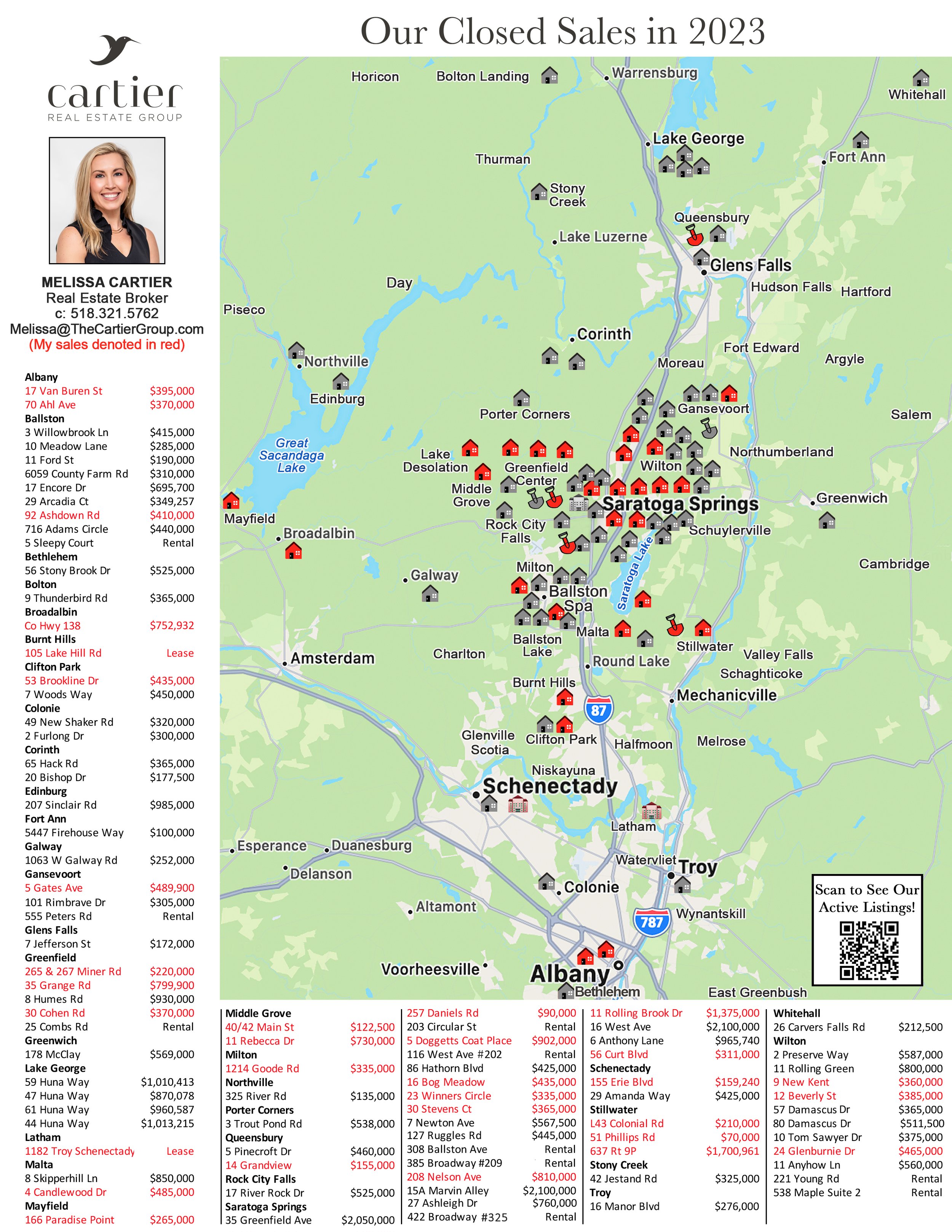

Hopefully 2025 is off to a promising start! Friends and neighbors are often curious about how our local real estate market is performing. Each February I provide a recap of the prior year’s market statistics for the Capital Region and share our company’s map of closed sales. Here’s a summary of yet another interesting year as your local REALTOR.

2024 Market Recap:

The consistently competitive residential market throughout 2024 surprised many who thought demand might subside due to inflation and interest rates. While mortgage interest rates remain low historically, they didn’t feel that way for local buyers facing rates that peaked at 8% before settling in the 6-7% range. Most buyers have adapted to the new normal, and sales weren’t negatively affected as many feared.

The continued strong demand for properties is likely due to the overall low inventory of homes occurring nationwide. Sellers with low interest rates are reluctant to trade them for higher rates without a very strong motivation to move. The total number of new listings throughout our area did increase by 2% after declining for three years straight. Sellers continued to win out overall, while buyers often fought to buy properties at a good value in competitive bid situations.

Throughout the Capital Region, high demand pushed 2024’s average list price up 8% to $421,663 throughout the Capital Region and 2024’s average sale price up 7% to $371,642 from 2023. The average sale-to-list-price ratio stayed solid at 101%, indicating that buyers continued to pay over list price for homes they deemed worth it.

Buyers are not, however, willing to overpay to secure a home that isn’t in good condition, and we did see more price reductions in listings in 2024. In addition, we’ve been successful in negotiating on some buyers’ behalf for homes that work. We still see most buyers clamoring for new, pristine, or underpriced properties, but as it costs more to borrow money, offer overages have been generally more stringent.

The commercial real estate market has seen marked improvement year over year as many companies are now encouraging employees to return to working in person. Similarly, there has been increased funding and investment interest in restaurants, start-ups, and retail sites. Both established businesses and fully -leased properties that can demonstrate profitability continue to sell to eager investors.

2025 Market Forecast:

Though the average list and sale prices increased again, both increased by less than the prior year — perhaps suggesting that prices may stay put through 2025.

The greatest challenges for buyers will continue to be the shortage of listed properties combined with a tighter maximum budget thanks to high interest rates. New construction continues to be a solid option for those with the budget and time to build. But again, with limited inventory and the cost to build at an all-time high, this option is out of reach for many.

The top challenges for sellerswill be recognizing that prices have ceased to rise at the same rate and that a property’s sale price must account for the home’s condition — and may need adjustment to sell fast. The past notion of “just trying it” at a lofty price is now risky unless you’re comfortable waiting it out and negotiating — or lowering the price — in short order.

Still, there’s no reason for would-be sellers to wait for the spring market to list. Buyers with limited inventory are looking all the time, so capitalizing on a property’s value can be done any month of the year. As always, I’ll be glad to run a market analysis for you or anyone else you know.

Thank you for making me your partner in all things real estate and I hope your 2025 is healthy, happy, and prosperous!

Warm regards,

Melissa Cartier

Real Estate Broker/Owner

c: 518.321.5762

Michelle Collins

Hi there,

Hopefully 2025 is off to a promising start! Friends and neighbors are often curious about how our local real estate market is performing. Each February I provide a recap of the prior year’s market statistics for the Capital Region and share our company’s map of closed sales. Here’s a summary of yet another interesting year as your local REALTOR.

2024 Market Recap:

The consistently competitive residential market throughout 2024 surprised many who thought demand might subside due to inflation and interest rates. While mortgage interest rates remain low historically, they didn’t feel that way for local buyers facing rates that peaked at 8% before settling in the 6-7% range. Most buyers have adapted to the new normal, and sales weren’t negatively affected as many feared.

The continued strong demand for properties is likely due to the overall low inventory of homes occurring nationwide. Sellers with low interest rates are reluctant to trade them for higher rates without a very strong motivation to move. The total number of new listings throughout our area did increase by 2% after declining for three years straight. Sellers continued to win out overall, while buyers often fought to buy properties at a good value in competitive bid situations.

Throughout the Capital Region, high demand pushed 2024’s average list price up 8% to $421,663 throughout the Capital Region and 2024’s average sale price up 7% to $371,642 from 2023. The average sale-to-list-price ratio stayed solid at 101%, indicating that buyers continued to pay over list price for homes they deemed worth it.

Buyers are not, however, willing to overpay to secure a home that isn’t in good condition, and we did see more price reductions in listings in 2024. In addition, we’ve been successful in negotiating on some buyers’ behalf for homes that work. We still see most buyers clamoring for new, pristine, or underpriced properties, but as it costs more to borrow money, offer overages have been generally more stringent.

The commercial real estate market has seen marked improvement year over year as many companies are now encouraging employees to return to working in person. Similarly, there has been increased funding and investment interest in restaurants, start-ups, and retail sites. Both established businesses and fully -leased properties that can demonstrate profitability continue to sell to eager investors.

2025 Market Forecast:

Though the average list and sale prices increased again, both increased by less than the prior year — perhaps suggesting that prices may stay put through 2025.

The greatest challenges for buyers will continue to be the shortage of listed properties combined with a tighter maximum budget thanks to high interest rates. New construction continues to be a solid option for those with the budget and time to build. But again, with limited inventory and the cost to build at an all-time high, this option is out of reach for many.

The top challenges for sellerswill be recognizing that prices have ceased to rise at the same rate and that a property’s sale price must account for the home’s condition — and may need adjustment to sell fast. The past notion of “just trying it” at a lofty price is now risky unless you’re comfortable waiting it out and negotiating — or lowering the price — in short order.

Still, there’s no reason for would-be sellers to wait for the spring market to list. Buyers with limited inventory are looking all the time, so capitalizing on a property’s value can be done any month of the year. As always, I’ll be glad to run a market analysis for you or anyone else you know.

Thank you for making me your partner in all things real estate and I hope your 2025 is healthy, happy, and prosperous!

Warm regards,

Michelle Collins

Lic. Real Estate Salesperson

c: 518-275-3260

Colleen Cameron

Hi there,

Hopefully 2025 is off to a promising start! Friends and neighbors are often curious about how our local real estate market is performing. Each February I provide a recap of the prior year’s market statistics for the Capital Region and share our company’s map of closed sales. Here’s a summary of yet another interesting year as your local REALTOR.

2024 Market Recap:

The consistently competitive residential market throughout 2024 surprised many who thought demand might subside due to inflation and interest rates. While mortgage interest rates remain low historically, they didn’t feel that way for local buyers facing rates that peaked at 8% before settling in the 6-7% range. Most buyers have adapted to the new normal, and sales weren’t negatively affected as many feared.

The continued strong demand for properties is likely due to the overall low inventory of homes occurring nationwide. Sellers with low interest rates are reluctant to trade them for higher rates without a very strong motivation to move. The total number of new listings throughout our area did increase by 2% after declining for three years straight. Sellers continued to win out overall, while buyers often fought to buy properties at a good value in competitive bid situations.

Throughout the Capital Region, high demand pushed 2024’s average list price up 8% to $421,663 throughout the Capital Region and 2024’s average sale price up 7% to $371,642 from 2023. The average sale-to-list-price ratio stayed solid at 101%, indicating that buyers continued to pay over list price for homes they deemed worth it.

Buyers are not, however, willing to overpay to secure a home that isn’t in good condition, and we did see more price reductions in listings in 2024. In addition, we’ve been successful in negotiating on some buyers’ behalf for homes that work. We still see most buyers clamoring for new, pristine, or underpriced properties, but as it costs more to borrow money, offer overages have been generally more stringent.

The commercial real estate market has seen marked improvement year over year as many companies are now encouraging employees to return to working in person. Similarly, there has been increased funding and investment interest in restaurants, start-ups, and retail sites. Both established businesses and fully -leased properties that can demonstrate profitability continue to sell to eager investors.

2025 Market Forecast:

Though the average list and sale prices increased again, both increased by less than the prior year — perhaps suggesting that prices may stay put through 2025.

The greatest challenges for buyers will continue to be the shortage of listed properties combined with a tighter maximum budget thanks to high interest rates. New construction continues to be a solid option for those with the budget and time to build. But again, with limited inventory and the cost to build at an all-time high, this option is out of reach for many.

The top challenges for sellerswill be recognizing that prices have ceased to rise at the same rate and that a property’s sale price must account for the home’s condition — and may need adjustment to sell fast. The past notion of “just trying it” at a lofty price is now risky unless you’re comfortable waiting it out and negotiating — or lowering the price — in short order.

Still, there’s no reason for would-be sellers to wait for the spring market to list. Buyers with limited inventory are looking all the time, so capitalizing on a property’s value can be done any month of the year. As always, I’ll be glad to run a market analysis for you or anyone else you know.

Thank you for making me your partner in all things real estate and I hope your 2025 is healthy, happy, and prosperous!

Warm regards,

Colleen Cameron

Licensed Real Estate Salesperson

c: 518.391.8312

Amanda Lampmon

Hi there,

Hopefully 2025 is off to a promising start! Friends and neighbors are often curious about how our local real estate market is performing. Each February I provide a recap of the prior year’s market statistics for the Capital Region and share our company’s map of closed sales. Here’s a summary of yet another interesting year as your local REALTOR.

2024 Market Recap:

The consistently competitive residential market throughout 2024 surprised many who thought demand might subside due to inflation and interest rates. While mortgage interest rates remain low historically, they didn’t feel that way for local buyers facing rates that peaked at 8% before settling in the 6-7% range. Most buyers have adapted to the new normal, and sales weren’t negatively affected as many feared.

The continued strong demand for properties is likely due to the overall low inventory of homes occurring nationwide. Sellers with low interest rates are reluctant to trade them for higher rates without a very strong motivation to move. The total number of new listings throughout our area did increase by 2% after declining for three years straight. Sellers continued to win out overall, while buyers often fought to buy properties at a good value in competitive bid situations.

Throughout the Capital Region, high demand pushed 2024’s average list price up 8% to $421,663 throughout the Capital Region and 2024’s average sale price up 7% to $371,642 from 2023. The average sale-to-list-price ratio stayed solid at 101%, indicating that buyers continued to pay over list price for homes they deemed worth it.

Buyers are not, however, willing to overpay to secure a home that isn’t in good condition, and we did see more price reductions in listings in 2024. In addition, we’ve been successful in negotiating on some buyers’ behalf for homes that work. We still see most buyers clamoring for new, pristine, or underpriced properties, but as it costs more to borrow money, offer overages have been generally more stringent.

The commercial real estate market has seen marked improvement year over year as many companies are now encouraging employees to return to working in person. Similarly, there has been increased funding and investment interest in restaurants, start-ups, and retail sites. Both established businesses and fully -leased properties that can demonstrate profitability continue to sell to eager investors.

2025 Market Forecast:

Though the average list and sale prices increased again, both increased by less than the prior year — perhaps suggesting that prices may stay put through 2025.

The greatest challenges for buyers will continue to be the shortage of listed properties combined with a tighter maximum budget thanks to high interest rates. New construction continues to be a solid option for those with the budget and time to build. But again, with limited inventory and the cost to build at an all-time high, this option is out of reach for many.

The top challenges for sellerswill be recognizing that prices have ceased to rise at the same rate and that a property’s sale price must account for the home’s condition — and may need adjustment to sell fast. The past notion of “just trying it” at a lofty price is now risky unless you’re comfortable waiting it out and negotiating — or lowering the price — in short order.

Still, there’s no reason for would-be sellers to wait for the spring market to list. Buyers with limited inventory are looking all the time, so capitalizing on a property’s value can be done any month of the year. As always, I’ll be glad to run a market analysis for you or anyone else you know.

Thank you for making me your partner in all things real estate and I hope your 2025 is healthy, happy, and prosperous!

Warm regards,

Amanda Lampmon

Lic. Real Estate Salesperson

c: 518-366-2040

Gerald Magoolaghan

Hi there,

Hopefully 2025 is off to a promising start! Friends and neighbors are often curious about how our local real estate market is performing. Each February I provide a recap of the prior year’s market statistics for the Capital Region and share our company’s map of closed sales. Here’s a summary of yet another interesting year as your local REALTOR.

2024 Market Recap:

The consistently competitive residential market throughout 2024 surprised many who thought demand might subside due to inflation and interest rates. While mortgage interest rates remain low historically, they didn’t feel that way for local buyers facing rates that peaked at 8% before settling in the 6-7% range. Most buyers have adapted to the new normal, and sales weren’t negatively affected as many feared.

The continued strong demand for properties is likely due to the overall low inventory of homes occurring nationwide. Sellers with low interest rates are reluctant to trade them for higher rates without a very strong motivation to move. The total number of new listings throughout our area did increase by 2% after declining for three years straight. Sellers continued to win out overall, while buyers often fought to buy properties at a good value in competitive bid situations.

Throughout the Capital Region, high demand pushed 2024’s average list price up 8% to $421,663 throughout the Capital Region and 2024’s average sale price up 7% to $371,642 from 2023. The average sale-to-list-price ratio stayed solid at 101%, indicating that buyers continued to pay over list price for homes they deemed worth it.

Buyers are not, however, willing to overpay to secure a home that isn’t in good condition, and we did see more price reductions in listings in 2024. In addition, we’ve been successful in negotiating on some buyers’ behalf for homes that work. We still see most buyers clamoring for new, pristine, or underpriced properties, but as it costs more to borrow money, offer overages have been generally more stringent.

The commercial real estate market has seen marked improvement year over year as many companies are now encouraging employees to return to working in person. Similarly, there has been increased funding and investment interest in restaurants, start-ups, and retail sites. Both established businesses and fully -leased properties that can demonstrate profitability continue to sell to eager investors.

2025 Market Forecast:

Though the average list and sale prices increased again, both increased by less than the prior year — perhaps suggesting that prices may stay put through 2025.

The greatest challenges for buyers will continue to be the shortage of listed properties combined with a tighter maximum budget thanks to high interest rates. New construction continues to be a solid option for those with the budget and time to build. But again, with limited inventory and the cost to build at an all-time high, this option is out of reach for many.

The top challenges for sellerswill be recognizing that prices have ceased to rise at the same rate and that a property’s sale price must account for the home’s condition — and may need adjustment to sell fast. The past notion of “just trying it” at a lofty price is now risky unless you’re comfortable waiting it out and negotiating — or lowering the price — in short order.

Still, there’s no reason for would-be sellers to wait for the spring market to list. Buyers with limited inventory are looking all the time, so capitalizing on a property’s value can be done any month of the year. As always, I’ll be glad to run a market analysis for you or anyone else you know.

Thank you for making me your partner in all things real estate and I hope your 2025 is healthy, happy, and prosperous!

Warm regards,

Gerald Magoolaghan

Lic. Real Estate Salesperson

c: 518.788.8220

Nicole Mazzotti

Hi there,

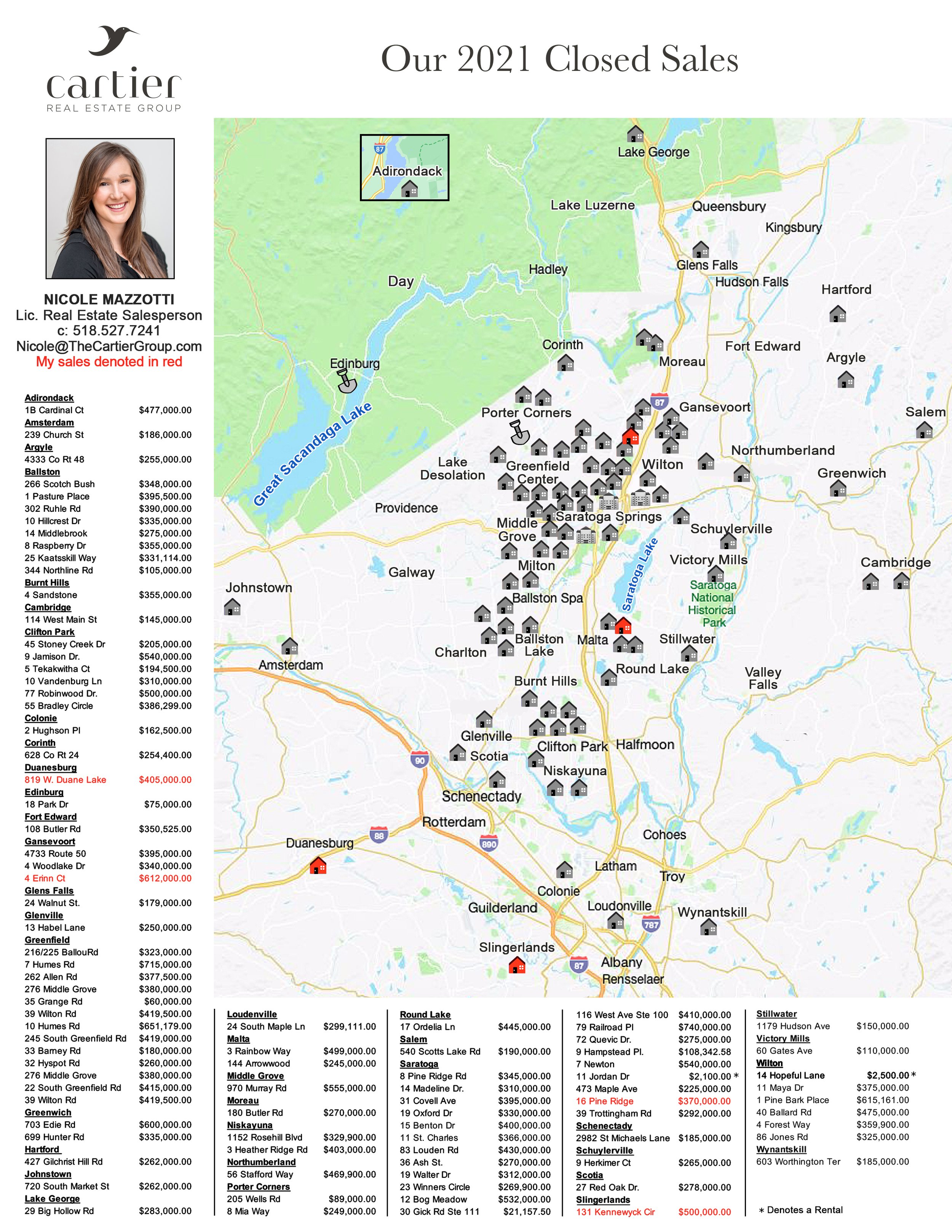

Hopefully 2025 is off to a promising start! Friends and neighbors are often curious about how our local real estate market is performing. Each February I provide a recap of the prior year’s market statistics for the Capital Region and share our company’s map of closed sales. Here’s a summary of yet another interesting year as your local REALTOR.

2024 Market Recap:

The consistently competitive residential market throughout 2024 surprised many who thought demand might subside due to inflation and interest rates. While mortgage interest rates remain low historically, they didn’t feel that way for local buyers facing rates that peaked at 8% before settling in the 6-7% range. Most buyers have adapted to the new normal, and sales weren’t negatively affected as many feared.

The continued strong demand for properties is likely due to the overall low inventory of homes occurring nationwide. Sellers with low interest rates are reluctant to trade them for higher rates without a very strong motivation to move. The total number of new listings throughout our area did increase by 2% after declining for three years straight. Sellers continued to win out overall, while buyers often fought to buy properties at a good value in competitive bid situations.

Throughout the Capital Region, high demand pushed 2024’s average list price up 8% to $421,663 throughout the Capital Region and 2024’s average sale price up 7% to $371,642 from 2023. The average sale-to-list-price ratio stayed solid at 101%, indicating that buyers continued to pay over list price for homes they deemed worth it.

Buyers are not, however, willing to overpay to secure a home that isn’t in good condition, and we did see more price reductions in listings in 2024. In addition, we’ve been successful in negotiating on some buyers’ behalf for homes that work. We still see most buyers clamoring for new, pristine, or underpriced properties, but as it costs more to borrow money, offer overages have been generally more stringent.

The commercial real estate market has seen marked improvement year over year as many companies are now encouraging employees to return to working in person. Similarly, there has been increased funding and investment interest in restaurants, start-ups, and retail sites. Both established businesses and fully -leased properties that can demonstrate profitability continue to sell to eager investors.

2025 Market Forecast:

Though the average list and sale prices increased again, both increased by less than the prior year — perhaps suggesting that prices may stay put through 2025.

The greatest challenges for buyers will continue to be the shortage of listed properties combined with a tighter maximum budget thanks to high interest rates. New construction continues to be a solid option for those with the budget and time to build. But again, with limited inventory and the cost to build at an all-time high, this option is out of reach for many.

The top challenges for sellerswill be recognizing that prices have ceased to rise at the same rate and that a property’s sale price must account for the home’s condition — and may need adjustment to sell fast. The past notion of “just trying it” at a lofty price is now risky unless you’re comfortable waiting it out and negotiating — or lowering the price — in short order.

Still, there’s no reason for would-be sellers to wait for the spring market to list. Buyers with limited inventory are looking all the time, so capitalizing on a property’s value can be done any month of the year. As always, I’ll be glad to run a market analysis for you or anyone else you know.

Thank you for making me your partner in all things real estate and I hope your 2025 is healthy, happy, and prosperous!

Warm regards,

Nicole Mazzotti

Lic. Real Estate Salesperson

c: 518-527-7241

Nikki@TheCartierGroup.com

Lara Nikolaidis

Hi there,

Hopefully 2025 is off to a promising start! Friends and neighbors are often curious about how our local real estate market is performing. Each February I provide a recap of the prior year’s market statistics for the Capital Region and share our company’s map of closed sales. Here’s a summary of yet another interesting year as your local REALTOR.

2024 Market Recap:

The consistently competitive residential market throughout 2024 surprised many who thought demand might subside due to inflation and interest rates. While mortgage interest rates remain low historically, they didn’t feel that way for local buyers facing rates that peaked at 8% before settling in the 6-7% range. Most buyers have adapted to the new normal, and sales weren’t negatively affected as many feared.

The continued strong demand for properties is likely due to the overall low inventory of homes occurring nationwide. Sellers with low interest rates are reluctant to trade them for higher rates without a very strong motivation to move. The total number of new listings throughout our area did increase by 2% after declining for three years straight. Sellers continued to win out overall, while buyers often fought to buy properties at a good value in competitive bid situations.

Throughout the Capital Region, high demand pushed 2024’s average list price up 8% to $421,663 throughout the Capital Region and 2024’s average sale price up 7% to $371,642 from 2023. The average sale-to-list-price ratio stayed solid at 101%, indicating that buyers continued to pay over list price for homes they deemed worth it.

Buyers are not, however, willing to overpay to secure a home that isn’t in good condition, and we did see more price reductions in listings in 2024. In addition, we’ve been successful in negotiating on some buyers’ behalf for homes that work. We still see most buyers clamoring for new, pristine, or underpriced properties, but as it costs more to borrow money, offer overages have been generally more stringent.

The commercial real estate market has seen marked improvement year over year as many companies are now encouraging employees to return to working in person. Similarly, there has been increased funding and investment interest in restaurants, start-ups, and retail sites. Both established businesses and fully -leased properties that can demonstrate profitability continue to sell to eager investors.

2025 Market Forecast:

Though the average list and sale prices increased again, both increased by less than the prior year — perhaps suggesting that prices may stay put through 2025.

The greatest challenges for buyers will continue to be the shortage of listed properties combined with a tighter maximum budget thanks to high interest rates. New construction continues to be a solid option for those with the budget and time to build. But again, with limited inventory and the cost to build at an all-time high, this option is out of reach for many.

The top challenges for sellerswill be recognizing that prices have ceased to rise at the same rate and that a property’s sale price must account for the home’s condition — and may need adjustment to sell fast. The past notion of “just trying it” at a lofty price is now risky unless you’re comfortable waiting it out and negotiating — or lowering the price — in short order.

Still, there’s no reason for would-be sellers to wait for the spring market to list. Buyers with limited inventory are looking all the time, so capitalizing on a property’s value can be done any month of the year. As always, I’ll be glad to run a market analysis for you or anyone else you know.

Thank you for making me your partner in all things real estate and I hope your 2025 is healthy, happy, and prosperous!

Warm Regards,

Lara Nikolaidis

Lic. Real Estate Salesperson

c: 518-527-4912

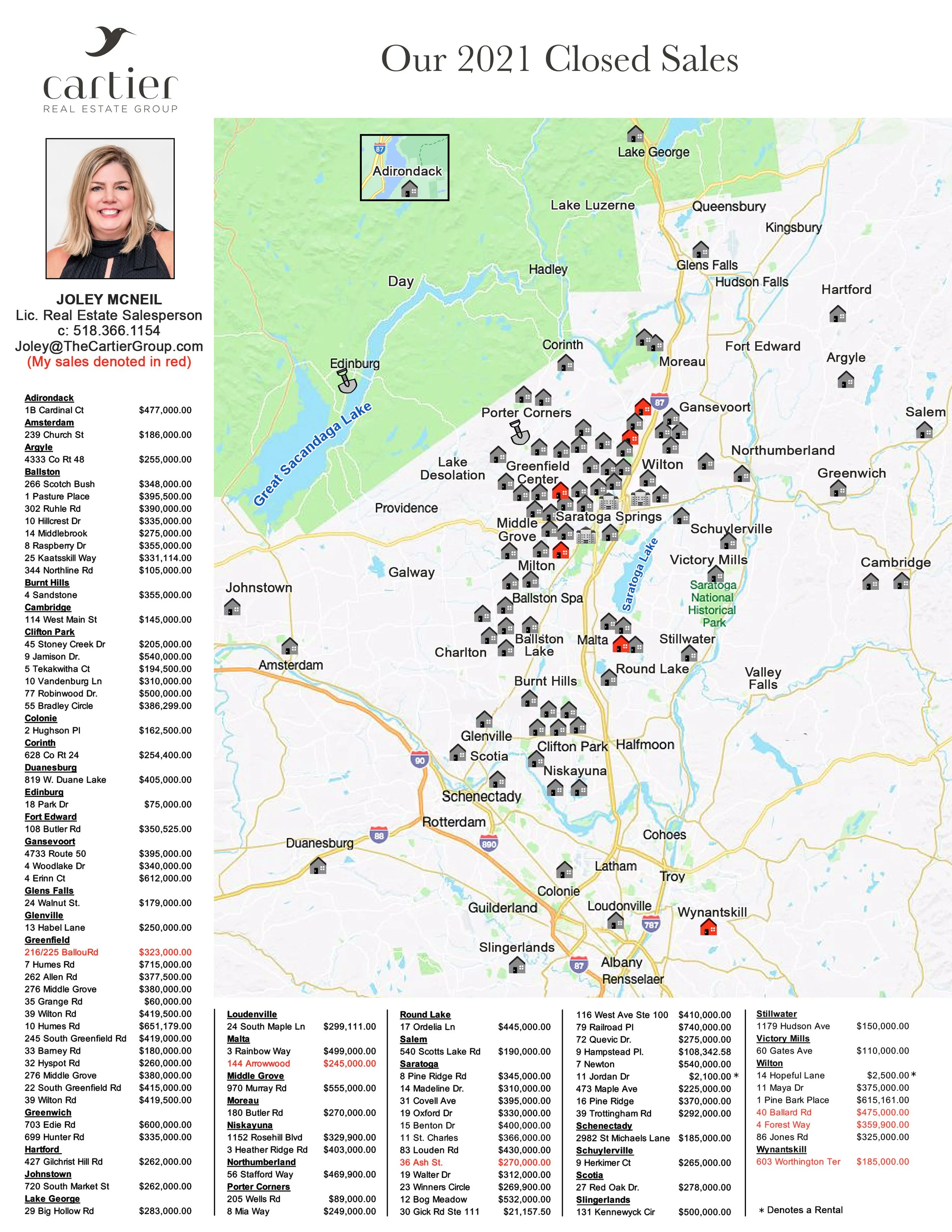

Joley Tetreault

Hi there,

Hopefully 2025 is off to a promising start! Friends and neighbors are often curious about how our local real estate market is performing. Each February I provide a recap of the prior year’s market statistics for the Capital Region and share our company’s map of closed sales. Here’s a summary of yet another interesting year as your local REALTOR.

2024 Market Recap:

The consistently competitive residential market throughout 2024 surprised many who thought demand might subside due to inflation and interest rates. While mortgage interest rates remain low historically, they didn’t feel that way for local buyers facing rates that peaked at 8% before settling in the 6-7% range. Most buyers have adapted to the new normal, and sales weren’t negatively affected as many feared.

The continued strong demand for properties is likely due to the overall low inventory of homes occurring nationwide. Sellers with low interest rates are reluctant to trade them for higher rates without a very strong motivation to move. The total number of new listings throughout our area did increase by 2% after declining for three years straight. Sellers continued to win out overall, while buyers often fought to buy properties at a good value in competitive bid situations.

Throughout the Capital Region, high demand pushed 2024’s average list price up 8% to $421,663 throughout the Capital Region and 2024’s average sale price up 7% to $371,642 from 2023. The average sale-to-list-price ratio stayed solid at 101%, indicating that buyers continued to pay over list price for homes they deemed worth it.

Buyers are not, however, willing to overpay to secure a home that isn’t in good condition, and we did see more price reductions in listings in 2024. In addition, we’ve been successful in negotiating on some buyers’ behalf for homes that work. We still see most buyers clamoring for new, pristine, or underpriced properties, but as it costs more to borrow money, offer overages have been generally more stringent.

The commercial real estate market has seen marked improvement year over year as many companies are now encouraging employees to return to working in person. Similarly, there has been increased funding and investment interest in restaurants, start-ups, and retail sites. Both established businesses and fully -leased properties that can demonstrate profitability continue to sell to eager investors.

2025 Market Forecast:

Though the average list and sale prices increased again, both increased by less than the prior year — perhaps suggesting that prices may stay put through 2025.

The greatest challenges for buyers will continue to be the shortage of listed properties combined with a tighter maximum budget thanks to high interest rates. New construction continues to be a solid option for those with the budget and time to build. But again, with limited inventory and the cost to build at an all-time high, this option is out of reach for many.

The top challenges for sellerswill be recognizing that prices have ceased to rise at the same rate and that a property’s sale price must account for the home’s condition — and may need adjustment to sell fast. The past notion of “just trying it” at a lofty price is now risky unless you’re comfortable waiting it out and negotiating — or lowering the price — in short order.

Still, there’s no reason for would-be sellers to wait for the spring market to list. Buyers with limited inventory are looking all the time, so capitalizing on a property’s value can be done any month of the year. As always, I’ll be glad to run a market analysis for you or anyone else you know.

Thank you for making me your partner in all things real estate and I hope your 2025 is healthy, happy, and prosperous!

Warm regards,

Joley Tetreault

Lic. Real Estate Salesperson

c: 518-366-1154

Heather Willig

Hi there,

Hopefully 2025 is off to a promising start! Friends and neighbors are often curious about how our local real estate market is performing. Each February I provide a recap of the prior year’s market statistics for the Capital Region and share our company’s map of closed sales. Here’s a summary of yet another interesting year as your local REALTOR.

2024 Market Recap:

The consistently competitive residential market throughout 2024 surprised many who thought demand might subside due to inflation and interest rates. While mortgage interest rates remain low historically, they didn’t feel that way for local buyers facing rates that peaked at 8% before settling in the 6-7% range. Most buyers have adapted to the new normal, and sales weren’t negatively affected as many feared.

The continued strong demand for properties is likely due to the overall low inventory of homes occurring nationwide. Sellers with low interest rates are reluctant to trade them for higher rates without a very strong motivation to move. The total number of new listings throughout our area did increase by 2% after declining for three years straight. Sellers continued to win out overall, while buyers often fought to buy properties at a good value in competitive bid situations.

Throughout the Capital Region, high demand pushed 2024’s average list price up 8% to $421,663 throughout the Capital Region and 2024’s average sale price up 7% to $371,642 from 2023. The average sale-to-list-price ratio stayed solid at 101%, indicating that buyers continued to pay over list price for homes they deemed worth it.

Buyers are not, however, willing to overpay to secure a home that isn’t in good condition, and we did see more price reductions in listings in 2024. In addition, we’ve been successful in negotiating on some buyers’ behalf for homes that work. We still see most buyers clamoring for new, pristine, or underpriced properties, but as it costs more to borrow money, offer overages have been generally more stringent.

The commercial real estate market has seen marked improvement year over year as many companies are now encouraging employees to return to working in person. Similarly, there has been increased funding and investment interest in restaurants, start-ups, and retail sites. Both established businesses and fully -leased properties that can demonstrate profitability continue to sell to eager investors.

2025 Market Forecast:

Though the average list and sale prices increased again, both increased by less than the prior year — perhaps suggesting that prices may stay put through 2025.

The greatest challenges for buyers will continue to be the shortage of listed properties combined with a tighter maximum budget thanks to high interest rates. New construction continues to be a solid option for those with the budget and time to build. But again, with limited inventory and the cost to build at an all-time high, this option is out of reach for many.

The top challenges for sellerswill be recognizing that prices have ceased to rise at the same rate and that a property’s sale price must account for the home’s condition — and may need adjustment to sell fast. The past notion of “just trying it” at a lofty price is now risky unless you’re comfortable waiting it out and negotiating — or lowering the price — in short order.

Still, there’s no reason for would-be sellers to wait for the spring market to list. Buyers with limited inventory are looking all the time, so capitalizing on a property’s value can be done any month of the year. As always, I’ll be glad to run a market analysis for you or anyone else you know.

Thank you for making me your partner in all things real estate and I hope your 2025 is healthy, happy, and prosperous!

Warm regards,

Heather Willig

Lic. Real Estate Salesperson

c: 518.339.1534